Membership

Knowledge Hub

STAY CONNECTED

If you would like to stay informed of our activities, please sign up to receive updates.

Member Organisations

Progress Against sub Pillars

Framework Documents

| Country | Policies/ Principles/ Guidelines | Year | Issuer |

|---|---|---|---|

| Cambodia | 2020 | Association of Banks in Cambodia | |

| Cambodia | 2019 | Association of Banks in Cambodia | |

| Cambodia | 2016 | Association of Banks in Cambodia |

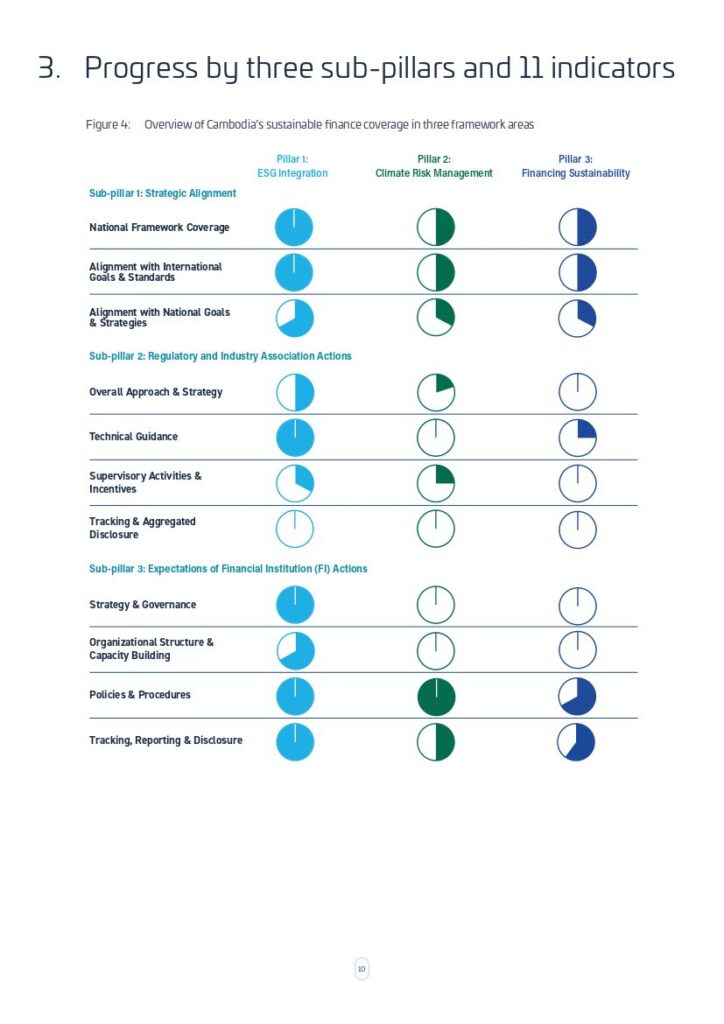

Pillar 1 - ESG Integration - Strategic Alignment

National Framework

Yes

P 1.2 – Has the relevant regulator or industry association published a Framework for capital markets, investment, insurance or other non-lending FIs that sets out expectations for integrating the consideration of environmental, social, and governance (ESG) risks and performance?

Yes

Pillar 1 - ESG Integration - Strategic Alignment

Alignment with International Goals & Standards

P 1.3 – Does the Framework make reference to international sustainable development frameworks or goals?

Yes

P 1.4 – Does the Framework make reference to established international ESG risk management standards and principles for FIs??

Yes

Pillar 1 - ESG Integration - Strategic Alignment

Alignment with national goals & strategies

Yes

P 1.6 – Does any cooperation exist between agencies or between the regulator and industry association with respect to policy design and/or implementation related to ESG integration?

Yes

P 1.7 – Does any inter-agency data sharing currently exist related to ESG integration by FIs?

No

Pillar 1 - ESG Integration - Regulatory and Industry Association Actions

Overall Approach & Strategy

P 1.8 – Does the Framework provide guidance on the role of the regulator or industry association with regard to assessing and managing ESG risk and performance in the financial sector?

Yes

P 1.9 – Has the regulator or industry association undertaken market assessment to identify systemic ESG risks through analysis of the portfolios of supervised entities/members and published the results?

No

Pillar 1 - ESG Integration - Regulatory and Industry Association Actions

Technical Guidance

P 1.10 – Does the Framework provide technical guidance or tools to support implementation of ESG risk and performance management by the financial sector?

Yes

Pillar 1 - ESG Integration - Regulatory and Industry Association Actions

Supervisory Activities & incentives

P 1.11 – Is the implementation of the Framework regularly monitored and/or information regularly collected from FIs by the regulator and/or industry association?

Yes

P 1.12 – Does the regulator or industry association provide any financial or non-financial incentives for FIs to manage ESG performance as part of the Framework?

No

P 1.13 – Does the regulator or industry association apply any disincentives/penalties for non-compliance by FIs in terms of expectations from the regulator and/or industry association related to ESG risk management as part of the Framework?

No

Pillar 1 - ESG Integration - Regulatory and Industry Association Actions

Tracking & Aggregated Disclosure

P 1.14 – Has the regulator or industry association established a data collection approach and database to track or regularly publish data related to ESG integration by FIs as part of the Framework?

No

Pillar 1 - ESG Integration - Expectations of FI Actions

Strategy & Governance

P 1.15 – Does the Framework require/ask the FI’s board of directors (or highest governing body) to approve an ESRM and/or ESG integration strategy, and to supervise its implementation?

Yes

Source Reference Detail

Source Reference Document

Pillar 1 - ESG Integration - Expectations of FI Actions

Organizational Structure & Capacity Building

P 1.16 – Does the Framework require/ask FIs to allocate resources/budget commensurate with portfolio ESG risks and define roles and responsibilities for ESG integration within the organization?

Yes

P 1.17 – Does the Framework require/ask FIs to develop and maintain the ESG expertise and capacity of staff commensurate with portfolio ESG risks through regular training and learning?

Yes

P 1.18 – Does the Framework require/ask FIs to create incentives for managers to reduce the ESG risk-level of the portfolio over a specified timeframe?

No

Pillar 1 - ESG Integration - Expectations of FI Actions

Policies & Procedures

P 1.19 – Does the Framework require/ask FIs to develop policies and procedures to identify, classify, measure, monitor, and manage ESG risks and performance throughout the financing cycle at the client level and/or the transaction/project level?

Yes

P 1.20 – Does the Framework require/ask FIs to undertake a regular review and monitoring of ESG risk exposure at aggregate portfolio level?

Yes

P 1.21 – Does the Framework require/ask FIs to establish and maintain an external inquiry/complaints/grievance mechanism for interested and affected stakeholders in relation to ESG practices?

Yes

Pillar 1 - ESG Integration - Expectations of FI Actions

Tracking, Reporting & Disclosure

P 1.22 – Does the Framework require/ask FIs to report ESG risks and performance to the regulator or industry association?

Yes

P 1.23 – Does the Framework require/ask FIs to report on ESG integration publicly?

Yes

P 1.24 – Does the Framework require/ask FIs to track credit risk (e.g. loan defaults) and/or financial returns in relation to ESG risk level?

Yes

Pillar 2 - Climate Risk Management - Strategic Alignment

National Framework

P 2.25 – Has the regulator or industry association published a national framework (“Framework”) for the banking sector that sets out expectations for integrating the consideration and management of climate risks and their impact in the national economy?

Yes

P 2.26 – Has the relevant regulator or industry association published a Framework for capital markets, investment, insurance or other non-lending FIs that sets out expectations for integrating the consideration and management of climate risks and their impact in the national economy?

No

Pillar 2 - Climate Risk Management - Strategic Alignment

Alignment with International Goals & Standards

P 2.27 – Does the Framework make reference to international agreements or frameworks to address climate?

No

Yes

Pillar 2 - Climate Risk Management - Strategic Alignment

Alignment with National Goals & Strategies

P 2.29 – Has the regulator or industry association aligned the Framework with national goals to address climate change in line with the country’s Nationally Determined Contributions (NDCs) to the Paris Agreement?

No

P 2.30 – Does any cooperation exist between agencies, or between government and industry association, with respect to policy design or implementation related to climate risk management?

No

P 2.31 – Does any inter-agency data sharing currently exist related to climate risk management by FIs?

No

Pillar 2 - Climate Risk Management - Regulatory and Industry Association Actions

Overall Approach & Strategy

P 2.32 – Has the regulator or industry association undertaken research on historical impacts to the economy and financial sector from climate change, and/or future expected impacts resulting from physical and transition climate risks?

Yes

P 2.33 -Does the Framework identify key sources of GHG emissions – such as in particular sectors – as priorities in the proactive management of climate risks by the financial sector?

No

P 2.34 – Does the Framework incorporate the conservation/restoration of natural carbon sinks (such as oceans, forests, mangroves, grasslands, and soils) as an important part of reducing climate change risks? (e.g., through guidelines, scenario analysis, targets, or incentives for FIs)

No

P 2.35 – Has the regulator or industry association developed an internal strategy to address climate risk, and/or embedded climate risk management into its governance, organizational structures, and budget as part of the Framework?

No

P 2.36 – Has the regulator or industry association undertaken any activities to expand and deepen analytical understanding of national and/or cross-border physical and transition climate risks, and to raise awareness as to how these risks may transmit to, and impact, the financial sector?

No

–

–

Pillar 2 - Climate Risk Management - Regulatory and Industry Association Actions

Technical Guidance

P 2.37 – Has the regulator or industry association developed risk assessment approaches, methodologies, or tools to understand and assess the financial sector’s exposure to climate risk as part of the Framework?

No

Pillar 2 - Climate Risk Management - Regulatory and Industry Association Actions

Supervisory Activities & Incentives

P 2.38 – As part of the Framework, has the regulator clarified supervisory expectations with regard to climate risk management by FIs, including consideration of international good practices?

No

P 2.39 – Has the regulator started to explicitly embed climate-related risk in supervisory activities and review processes as part of the Framework?

No

P 2.40 – Has the regulator started to explicitly embed climate-related risk in supervisory activities and review processes as part of the Framework?

Yes

P 2.41 – Has the regulator started to explicitly embed climate-related risk in supervisory activities and review processes as part of the Framework?

No

Pillar 2 - Climate Risk Management - Regulatory and Industry Association Actions

Tracking & Aggregated Disclosure

P 2.42 – Does the regulator or industry association regularly collect and/or report market-level and/or FI-level data on climate-related financial sector risks as part of the Framework?

No

Pillar 2 - Climate Risk Management - Expectations of FI Actions

Strategy & Governance

P 2.43 – Does the Framework require/ask FIs to establish a strategy for climate risk management with responsibility at the board of director level (or highest governing body)?

No

Pillar 2 - Climate Risk Management - Expectations of FI Actions

Organizational Structure & Capacity Building

P 2.44 – Does the Framework require/ask FIs to define the roles and responsibilities and related capacities of the FI’s senior management and operational staff in identifying, assessing, and managing climate-related financial risks and opportunities?

No

Pillar 2 - Climate Risk Management - Expectations of FI Actions

Policies & Procedures

P 2.45 – Does the Framework require/ask FIs to expand existing risk management processes to identify, measure, monitor, and manage/mitigate financial risks from climate change?

Yes

Pillar 2 - Climate Risk Management - Regulatory and Industry Association Actions

Tracking, reporting & disclosure

P 2.46 – Does the Framework require/ask FIs to report on their overall approaches to climate risk management in line with international good practices (e.g., TCFD), or establish a timeline by which FIs should begin to align their reporting with such practices?

Yes

P 2.47 – Does the Framework require/ask FIs to identify, measure, and report on exposure to sectors which are vulnerable to transition risk and physical risk?

Yes

P 2.48 – Does the Framework require/ask FIs to adopt and report on performance targets to reduce portfolio greenhouse gas (GHG) emissions on a regular basis?

Yes

P 2.49 – Does the Framework require/ask FIs to adopt and report on performance targets to reduce exposure to climate change risks at the portfolio level on a regular basis?

No

Pillar 3 - Financing Sustainability - Strategic Alignment

National Framework

P 3.50 – Has the regulator or industry association published a national framework (“Framework”) for the banking sector that sets out expectations for integrating the consideration of instruments, goals, and standards for financing sustainability, including requirements for ensuring credibility and managing and measuring resulting impacts in the national economy?

Yes

P 3.51 – Has the relevant regulator or industry association published a Framework for capital markets, investment, insurance or other non-lending FIs that sets out expectations for integrating the consideration of instruments, goals, and standards for financing sustainability, including requirements for ensuring credibility and managing and measuring resulting impacts in the national economy

No

Pillar 3 - Financing Sustainability - Strategic Alignment

Alignment with International Goals & Standards

P 3.52 – Has the regulator or industry association developed a strategy, regulations, or set of frameworks for stimulating the allocation of capital to sustainable assets, projects, and related sectors in line with global goals, such as the Sustainable Development Goals (SDGs)?

Yes

P 3.53 – Does the Framework recognize and/or align with existing standards, voluntary principles, or market good practices related to sustainable finance instruments?

No

Pillar 3 - Financing Sustainability - Regulatory and Industry Association Actions

Alignment with national goals & strategies

P 3.54 – Does the Framework enable the achievement of stated national objectives by guiding capital to sectors, assets, and projects that have environmental and social benefits in line with national sustainable development priorities, strategies, targets, and the size of sustainable investment needs, and taking into account the local barriers to scaling-up sustainable finance?

Yes

–

Page 15 – 6.2

P 3.55 – Does the Framework enable the achievement of stated national objectives by guiding capital to sectors, assets, and projects that have environmental and social benefits in line with national sustainable development priorities, strategies, targets, and the size of sustainable investment needs, and taking into account the local barriers to scaling-up sustainable finance?

No

P 3.56 – Does any inter-agency data sharing currently exist related to stimulating and monitoring sustainable finance flows?

No

Pillar 3 - Financing Sustainability - Strategic Alignment

Overall Approach & Strategy

P 3.57 – Does the Framework require/ask the regulator or industry association to establish mechanisms to identify and encourage the allocation of capital to sustainable sectors, assets, and projects?

No

Pillar 3 - Financing Sustainability - Regulatory and Industry Association Actions

Technical Guidance

P 3.58 – Does the Framework require/ask the regulator or industry association to establish mechanisms to identify and encourage the allocation of capital to sustainable sectors, assets, and projects?

Yes

P 3.59 – Does the Framework provide guidelines for extending green, social or sustainability-focused loans (excluding bonds)?

No

P 3.60 – Does the Framework provide guidelines for issuance of green, social or sustainability bonds?

No

P 3.61 – Does the Framework require/ask for external party verification to ensure the credibility of sustainability instruments?

No

Pillar 3 - Financing Sustainability - Regulatory and Industry Association Actions -

Supervisory activities & incentives

P 3.62 – Does the regulator or industry association monitor information reported by FIs related to green/social/sustainability investment, lending, and other instruments to prevent greenwashing and social-washing?

No

P 3.63 – Are there any financial or non-financial incentives for FIs to develop and grow green, social, or sustainability finance instruments?

No

Pillar 3 - Financing Sustainability - Regulatory and Industry Association Actions -

Tracking & Aggregated Disclosure

P 3.64 – Does the regulator or industry association collect and/or publish data from FIs or other sources about allocation of capital to green/social/sustainability assets, projects, or sectors?

No

Pillar 3 - Financing Sustainability - Expectations of FI Actions

Strategy & Governance

P 3.65 – Does the Framework require/ask FIs to establish a strategy, governance, or high-level targets, including at the Board of Directors level, for capital allocation to sustainable assets, projects, or sectors?

No

Pillar 3 - Financing Sustainability - Expectations of FI Actions

Organizational Structure & Capacity Building

P 3.66 – Does the Framework require/ask FIs to define internal staff roles and responsibilities to encourage finance flows to green, social, and/or sustainability-focused investments?

No

P 3.67 – Does the Framework require/ask FIs to develop and maintain internal staff capacity on green, social, or sustainability products through regular training and learning?

Yes

Pillar 3 - Financing Sustainability - Expectations of FI Actions

Policies & Procedures

P 3.68 – Does the Framework require/ask FIs to put in place policies and procedures for defining, issuing, managing proceeds, tracking performance, and reporting on green, social or sustainability-focused products?

Yes

P 3.69 – Does the Framework require/ask FIs to appoint an independent external reviewer to confirm that the FI’s internal framework meets the requirements of the recognized national framework and regulations, or aligns to international standards?

Yes

P 3.70 – Does the Framework require/ask that FIs create incentives for managers to increase sustainable loans or investments in the portfolio?

No

Pillar 3 - Financing Sustainability - Expectations of FI Actions

Tracking, reporting & disclosure

P 3.71 – Does the Framework require/ask FIs to publish annual updates on the performance and impacts of the sustainability instruments in compliance with relevant national and/or international standards?

No

P 3.72 – Does the Framework require/ask FIs to obtain and disclose independent review of metrics reported annually in relation to the social and environmental outcomes and impacts achieved through the sustainability instruments?

No

P 3.73 – Does the Framework require/ask FIs to obtain and disclose independent review of metrics reported annually in relation to the social and environmental outcomes and impacts achieved through the sustainability instruments?

Yes

P 3.74 – Does the Framework require/ask FIs to report to the regulator(s) or industry association(s) on green, social, and/or sustainability bonds or other positive impact investments?

Yes

P 3.75 – Does the Framework require/ask FIs to report publicly on their green, social and sustainability-focused finance activities and positive outcomes or impacts (i.e. not only to the regulator or shareholders)?

Yes

If you would like to stay informed of our activities, please sign up to receive updates.